People and businesses need reliable, affordable, and easy-to-use currency exchange options in today’s more interconnected world. International transactions are difficult because traditional banks and financial institutions frequently charge high fees and provide unfavorable currency rates. Financial technology (FinTech) companies such as Revolut have revolutionized the currency exchange industry in the current digital era.

Vlad Yatsenko and Nikolay Storonsky launched the FinTech company Revolut in London in 2015. The organization has gained significant recognition for its proactive approach to adopting digital banking technology, specifically in the realm of multi-currency trading. Revolut is a comprehensive financial services platform that offers users a consolidated mobile application for various banking, investing, and cryptocurrency trading functionalities, including efficient and cost-effective Revolut currency exchange services.

The Key Features of Revolut Currency Exchange

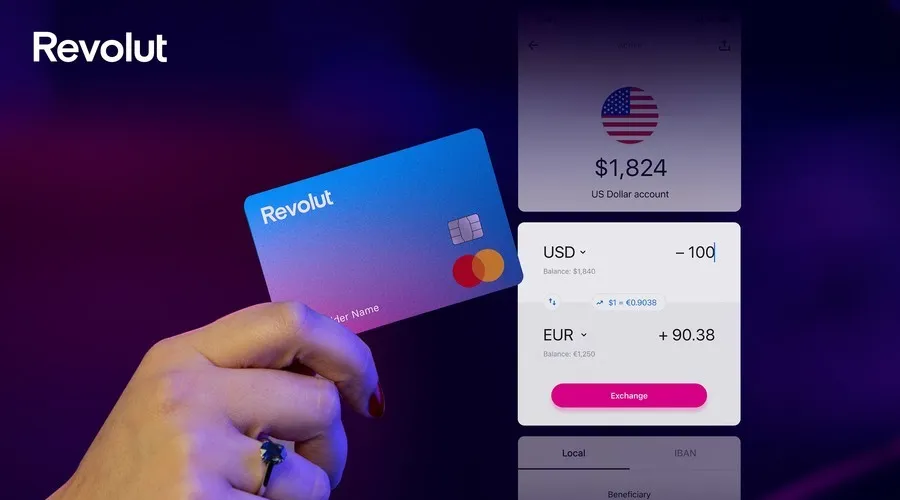

Revolut, a fintech company, has received a lot of attention in recent years thanks to the unique approach it takes to the provision of financial services. One of its most prominent features is its ability to convert currencies, which is used in a wide variety of contexts and may be modified in several ways. Revolut currency exchange capabilities go beyond the traditional offerings of banks and traditional currency exchange platforms.

Accessibility:

The accessibility of Revolut currency exchange is a really enticing aspect. Revolut, in contrast to conventional banking institutions, operates as a digital platform that facilitates financial management for individuals by means of a mobile application. This platform encompasses several functionalities, such as currency exchange, enabling users to effectively oversee their monetary affairs.

The enhanced accessibility provided by this feature is a significant development for both individuals and enterprises who engage in frequent overseas transactions. The Revolut application enables users to engage in currency exchange, conduct financial transactions, and monitor their expenditures continuously, regardless of their geographical location.

Multiple Currency Accounts:

Revolut offers multi-currency accounts to its users. This functionality enables individuals to possess, trade, and engage in financial transactions involving many currencies through a solitary account. This particular function proves to be quite advantageous for individuals who engage in travel, expatriates, as well as enterprises that maintain relationships with overseas clients or suppliers. Revolut account holders have the capability to store multiple currencies within their account, hence eliminating the necessity for maintaining distinct foreign currency accounts and incurring the accompanying charges.

Interbank Exchange Rates:

Revolut is renowned for its provision of highly competitive interbank exchange rates, which frequently surpass those offered by traditional banking institutions. Interbank rates refer to the exchange rates at which banks engage in currency transactions with each other. These rates typically closely align with the mid-market rates. By offering interbank exchange rates, Revolut ensures that users get a fair deal when converting their money. This feature can result in substantial savings, especially for frequent travelers or those conducting international business.

Also Read: Revolut’s Virtual Debit Card: Revolutionising Digital Banking

No Hidden Fees:

Revolut prides itself on transparency and offers a fee structure that is easy to understand. The platform does not charge hidden fees or markup on the exchange rates. Instead, they generate revenue from premium subscriptions and other financial services, ensuring that customers are aware of the cost of their currency exchange transactions upfront.

Real-Time Exchange:

Real-time foreign exchange on Revolut lets users change their money right away at the rate that is currently being used on the market. This particular function proves to be particularly advantageous in times of high volatility within the foreign currency market, as it empowers customers to make well-informed selections that will effectively optimize the use of their financial resources. Revolut users have the option to receive notifications and messages from the company in the event of a modification in the currency conversion rate.

Currency Pairs and Cryptocurrencies:

Revolut offers a wide range of supported currency pairs, covering major, minor, and exotic currencies. Users can exchange money between these pairs quickly and conveniently.

Challenges and Concerns:

While Revolut currency exchange services have received widespread acclaim, there are certain challenges and concerns:

a. Regulatory Oversight:

Revolut has faced scrutiny and regulatory challenges in various countries due to its rapid expansion and evolving business model. Ensuring compliance with financial regulations is crucial to sustaining its success.

b. Limited Physical Presence:

Revolut is primarily a digital platform, which means it lacks physical branches for in-person customer support. Some users may prefer face-to-face interactions when dealing with financial matters.

c. Exchange Rate Fluctuations:

While Revolut offers favorable exchange rates, these rates can still be subject to market fluctuations. Users should be aware of this and consider strategies to mitigate currency exchange risks.

Conclusion

The currency conversion service provided by Revolut is positioned as a leading player in the FinTech industry, presenting consumers with a novel and economically efficient approach to overseeing global financial transactions. The real-time conversion rates, multicurrency wallet, cost transparency, and other features offered by this platform offer notable benefits. Nevertheless, Revolut must confront potential regulatory obstacles and overcome the lack of physical branches in order to sustain its competitive advantage in the dynamic realm of digital banking and currency conversion. In an era characterized by the growing fluidity of borders, Revolut possesses the capacity to profoundly transform the manner in which cross-border financial transactions are conducted, owing to its smooth and efficient Revolut currency exchange services. For more information, visit the official website of Frontceleb.